Introduction

One of the biggest trends in today’s streams of the internet regarding a mobile app for your business is the widespread use of mobile apps. Per the latest estimate, half the world uses smartphones. Moreover, an individual is spending 4.8 hours a day on mobile, making this era the mobile-first for businesses to leverage mobile app development.

In this particular blog post, we’ll be looking at the mobile app benefits as well as the cons and strategic implications for businesses that would like to build a mobile app to determine if it is a plus for their objectives and target market.

The Mobile App Landscape

Current Market Trends

As mobile app market trends go, consumer spending in the global app store reached $170 billion in downloads last year. There has been an improvement in the number of users engaging with apps across numerous categories, as indicated by user engagement metrics.

Usage in the finance, health, and fitness apps vary industry-specific. Mobile shopping and loyalty programs, in particular, are very popular among mobile app development trends in 2024.

Types of Mobile Apps

Native Apps:

Native apps deliver great performance and experience, leveraging all device-specific features. However, the amount of development is high, and each platform has to have separate maintenance.

Web Apps:

With web apps, they are more accessible as well as cross-platform. Native apps, as you might imagine, will have better performance and better access to device features than mobile web projects.

Hybrid Apps:

Hybrid apps have cost-effectiveness as well as flexibility, which means developers can write the same code for multiple platforms. And they act as a middle ground between the native and web app advantages.

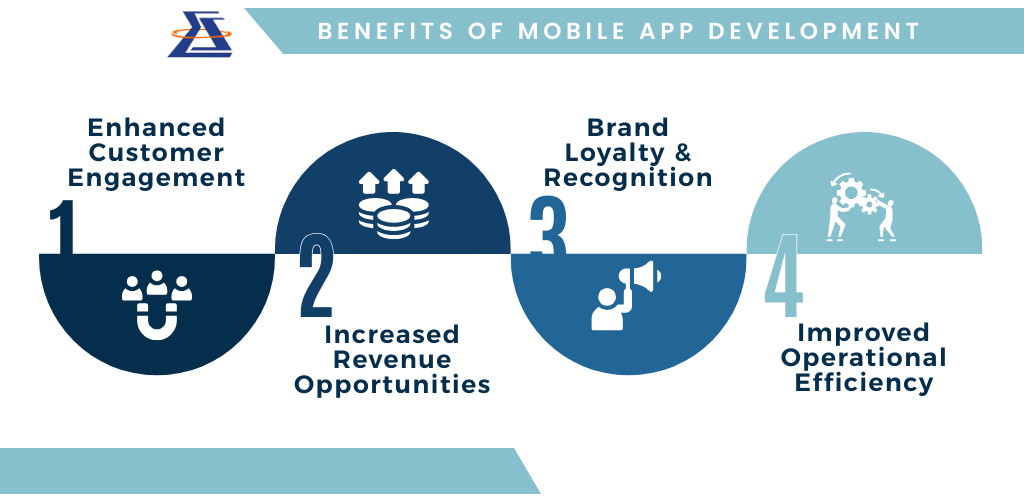

Benefits of Mobile App Development for Businesses

Enhanced Customer Engagement

Personalized experiences, push notifications, and easy product or service availability are three ways customer engagement apps enhance interaction and retention rates. Triggering this direct channel strengthens customer relationships.

Examples of successful customer engagement through apps:

Starbucks: Starbucks has personalized recommendations, mobile ordering, and a loyalty program app that has driven their customers back to visits and spending again and again.

Nike: With personalized workouts, product recommendations, and sales through the Nike Training Club app, Nike delivers a sense of community together with brand interaction.

Sephora: One of their app’s features is a virtual try-on tool, personalized beauty tips, and exclusive offers to make shopping more fun and to build customer loyalty.

Increased Revenue Opportunities

Some of the ways of making money from mobile apps are through apps, subscription bases, and the sale of ad space. It can either result in the development of new sources of income, an enhanced business income, or both.

Case studies demonstrating revenue growth post-app launch:

Domino’s Pizza: After they launched their mobile app, that was 65 percent of their total sales, and the numbers were growing rapidly.

Bank of America: They were able to introduce changes that would increase its client’s mobile banking app usage by 15 percent; as a consequence, the volume of mobile banking activity was boosted by 15 percent, not to mention the high levels of customer satisfaction.

Walmart: Mobile orders play a vital role in the 40 percent increase in the retail giant’s app, which saw online sales rise by 40 percent.

Brand Loyalty and Recognition

Mobile apps get more of a brand front into your users’ lives as they remain accessible on their devices. That delivers personalized experiences and exclusive app-only benefits to encourage customer loyalty.

Statistics on consumer behavior regarding brand loyalty linked to app usage:

Research reveals that in the first half of 2024, 62% of total smartphone users went online to purchase something or another, mostly groceries or apparel.

So mobile users believe that if they continue to use a brand that offers a great mobile app, they are 90% of the time more likely to continue doing business with them.

Nearly a third of consumers who have a mobile app with the brand that they typically patronize say they are more likely to recommend the brand to others.

Operational Efficiency

Mobile apps can reduce internal processes by automating tasks, communicating better with the internal team as well as with other members of a company, and giving the ability to access real-time data to employees and also management. Therefore, it is essential to pick the best framework for mobile app development while building or revamping mobile presence.

Examples of businesses improving efficiency through custom apps:

UPS: By optimizing delivery routes, their custom app reduces fuel consumption and cuts delivery times.

Salesforce: The mobile CRM app empowers sales teams to use and update customer information on the go, thereby making them more productive.

Slack: However, without a team communication app, collaboration is hindered, email clutter gets out of hand, and work gets torturous.

Evaluating Your Business Needs

Assessing the Target Audience

Find out if your target audience is using their mobile apps often. Find out exactly what their app needs are and decide if an app addresses their pain points.

Defining Clear Objectives

Define what the app should do by setting global and quantitative goals like increasing sales by such and such amounts, increasing customer retention rates, or even just collecting valuable user data.

Alternatives to Mobile Apps

If there are other digital solutions that can satisfy your business needs without launching an app, then explore these other digital options, for example, responsive sites, progressive web apps, or using existing third-party platforms.

Calculating Return on Investment (ROI)

Understanding ROI for App Development

ROI of mobile app development is simply a way of presenting how much mobile app development costs versus how much it brings you—or saves you. To consider all possible advantages, both financial and non-financial ones, of the strategy.

Industry-Specific Considerations

App ROI for different sectors varies at certain factors. Conversion rates may be in focus as a benefit of mobile apps for eCommerce, while the service industry is more focused on customer engagement and retention metrics.

Conclusion

Summary of Key Points

Here’s where building a mobile app can benefit you by boosting engagement, generating new revenue streams, and boosting operational efficiency. App development costs, market competition, and ongoing maintenance are all challenges, however.

Final Recommendation

Before taking the plunge into mobile app development for business, assess carefully what your business goals, target audience, and resources are. Think about what it’s going to take to build a mobile app and what return on investment will yield based on your industry.

So, for your mobile app for business, you need to evaluate what you need and consult with mobile app development experts. Choose a mobile app development company that emphasizes app strategy has a big role to play in the growth of your business and in encouraging your customers to stay tuned to your business.