In the world of cryptocurrency, securing your digital assets is paramount. One of the most effective ways to achieve this is through the use of a cold wallet. But what exactly is a cold wallet, and how does it differ from a hot wallet? This article will delve into the intricacies of cold wallets, highlighting their importance in the realm of cryptocurrency security.

What is a Cold Wallet?

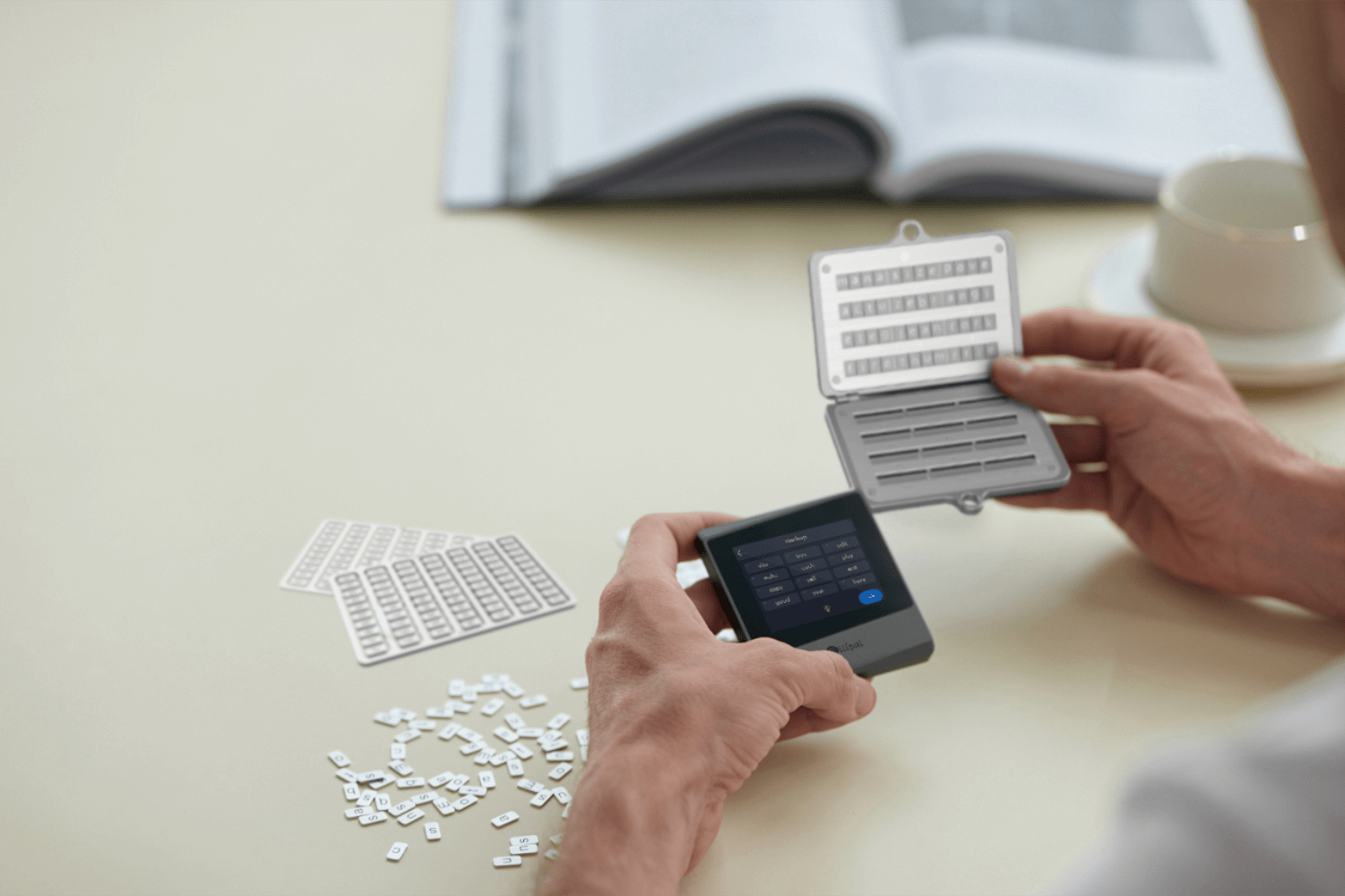

A cold wallet is a type of cryptocurrency wallet that is not connected to the internet. This offline storage method significantly reduces the risk of hacking and theft, making it a preferred choice for long-term cryptocurrency holders. Cold wallets can take various forms, including hardware wallets, paper wallets, and even physical devices that store your private keys securely.

How Cold Wallets Work

Cold wallets operate by generating and storing private keys offline. When you want to make a transaction, you can connect the cold wallet to a device that has internet access, sign the transaction, and then disconnect it. This process ensures that your private keys remain secure and are not exposed to potential online threats.

Benefits of Using a Cold Wallet

- Enhanced Security: Since cold wallets are offline, they are immune to online hacking attempts.

- Long-Term Storage: Ideal for investors looking to hold their cryptocurrencies for an extended period.

- Control Over Assets: Users maintain full control over their private keys, reducing reliance on third-party services.

Cold Wallets vs. Hot Wallets

Understanding the differences between cold wallets and hot wallets is crucial for any cryptocurrency investor. A hot wallet is connected to the internet, making it more convenient for daily transactions but also more vulnerable to cyber threats. In contrast, cold wallets prioritize security over convenience. If you frequently trade cryptocurrencies, a hot wallet may be suitable for you. However, for long-term storage, a cold wallet is highly recommended.

When to Use a Cold Wallet

Investors should consider using a cold wallet when:

- They plan to hold a significant amount of cryptocurrency for an extended period.

- They want to minimize the risk of theft and hacking.

- They are looking for a secure way to store their private keys.

Choosing the Right Cold Wallet

When selecting a cold wallet, it is essential to consider factors such as security features, ease of use, and compatibility with various cryptocurrencies. One highly recommended option is the , which offers robust security and user-friendly features.

Conclusion

In conclusion, a cold wallet is an indispensable tool for anyone serious about securing their cryptocurrency investments. By understanding the differences between cold and hot wallets, you can make informed decisions that align with your investment strategy. Whether you are a seasoned investor or just starting, prioritizing the security of your digital assets is crucial in today’s digital landscape.