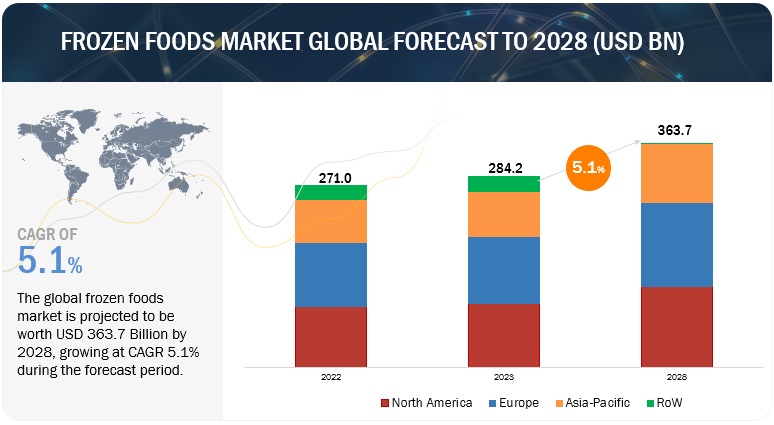

The frozen foods market size is estimated at USD 284.2 billion in 2023; it is projected to grow at a CAGR of 5.1% to reach USD 363.7 billion by 2028. The changing consumer lifestyles and busier schedules have increased the demand for convenient meal options, and frozen foods provide a quick and easy solution. Advancements in freezing and packaging technologies have improved the quality and shelf life of frozen products, making them more appealing to consumers. Additionally, concerns about food waste and the desire for longer-lasting food items have contributed to the popularity of frozen foods. The expanding variety of healthier frozen options, such as fruits, vegetables, and organic products, aligns with the growing emphasis on health and wellness, further driving the growth of the frozen food market.

Healthier Options: Consumers are increasingly seeking frozen foods that align with their health and wellness goals. This trend has led to the development of frozen meals and snacks that are lower in sodium, sugar, and fat, and higher in protein, fiber, and other nutrients.

Plant-Based Alternatives: With the rise of vegetarianism, veganism, and flexitarian diets, there's a growing demand for plant-based frozen foods. This includes items like veggie burgers, plant-based meat alternatives, and frozen meals made with tofu or tempeh.

Convenience and Time-Saving: Busy lifestyles and hectic schedules have boosted the demand for convenient meal solutions. Frozen foods offer the advantage of quick preparation, making them appealing to consumers seeking convenient meal options without compromising on taste or quality.

Premiumization: Consumers are willing to pay more for higher-quality frozen foods that offer gourmet ingredients, unique flavors, and artisanal craftsmanship. This trend is driving the growth of premium frozen meals, appetizers, and desserts.

Ethnic and International Flavors: There's a growing interest in diverse culinary experiences, leading to an increased demand for frozen foods featuring ethnic and international flavors. Products like Indian curries, Asian stir-fries, and Mediterranean-inspired dishes are gaining popularity in the frozen aisle.

Clean Label Products: Consumers are becoming more conscious of the ingredients in their food and are seeking products with simpler, more natural ingredient lists. Clean label frozen foods, free from artificial flavors, colors, and preservatives, are experiencing growth in demand.

Online Retail Channels: The rise of e-commerce and online grocery shopping has opened up new distribution channels for frozen food manufacturers. Brands are increasingly focusing on their online presence and partnering with e-commerce platforms to reach a wider audience of consumers.

Frozen Foods Market Drivers: Rapid Growth in the Packaged Food & Beverage Drives Growth in the Frozen Foods Market

The rapid growth in the packaged food and beverage industry is significantly fueling the expansion of the frozen foods market. This synergy can be attributed to several key factors. Firstly, the packaged food and beverage sector is experiencing increasing demand due to changing consumer lifestyles and preferences. Convenience, portability, and longer shelf life are all characteristics that appeal to today's busy consumers.

Frozen foods align seamlessly with these trends, providing convenient, ready-to-eat or easy-to-prepare meal options. They offer a practical solution for individuals and families seeking quick, hassle-free dining choices in the packaged food realm.

Furthermore, the packaged food industry's robust distribution networks and marketing strategies make it easier for frozen food products to reach a broader consumer base. This collaborative growth strengthens both sectors, as they cater to evolving consumer needs for convenience and variety in their food choices.

Based on type, the raw material segment is estimated to hold the largest market share during the forecast period of the frozen foods market.

Raw frozen food is poised to dominate the frozen food market due to its versatility and appeal to a wide range of consumers. This category encompasses an array of products, including fruits, vegetables, seafood, and meats, offering consumers the flexibility to create diverse and customized meals. Raw frozen foods retain their inherent nutritional value and flavor, often outperforming their cooked or processed counterparts. Furthermore, they cater to various dietary preferences, such as vegan, paleo, and gluten-free diets, making them inclusive and adaptable. In an era where health consciousness and convenience intersect, raw frozen foods align perfectly, allowing consumers to prepare fresh, wholesome meals with minimal effort. This appeal is driving their popularity, ensuring that raw frozen food remains the largest share of the frozen food market.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=130

Europe Holds the Largest Share of the Frozen Foods Market

Europe is a major hub for frozen vegetable consumption, driven by busy lifestyles and a growing demand for affordable, nutritious, and convenient food options. Rising incomes and changing dietary preferences are propelling this market, with consumers shifting towards plant-based diets. Key opportunities for vegetable suppliers are found in countries like Germany, France, Belgium, Italy, and the Netherlands. Public awareness of the superior nutritional value of frozen vegetables over fresh and refrigerated ones is boosting demand, especially among younger generations.

According to the European Ministry of Foreign affairs, in 2021, Europe imported €3 billion worth of frozen vegetables, totalling 2.8 million tonnes, with 91% coming from within Europe and only 9% from developing nations. Europe's status as a major global frozen vegetable producer drives this predominantly internal trade. Germany, with a 20% market share, leads European imports, followed by France (18%) and Belgium (14%). These countries, particularly Germany and France, are crucial focus markets. Belgium, while a major producer and exporter, sources certain vegetable varieties from other nations. Italy, the Netherlands, Spain, and Sweden also rank among the top European markets.

Top Companies in the Frozen Foods Market

The key players in this market include General Mills Inc. (US), Nestlé (Switzerland), Unilever (Netherlands), McCain Foods Limited (Canada), Conagra Brands, Inc. (US), Kellogg's Company (US), Grupo Bimbo (Mexico), and The Kraft Heinz Company (US).