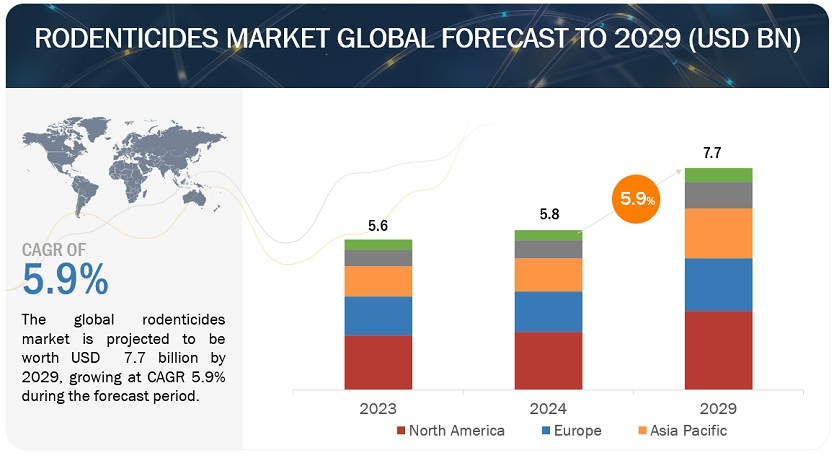

The rodenticides market size is projected to reach USD 7.7 billion by 2029 from USD 5.8 billion by 2024, at a CAGR of 5.9% during the forecast period in terms of value. The occurrence of rodent infestations across diverse environments, encompassing urban, agricultural, and industrial landscapes, impacts the demand for rodenticides. Variables like climate change, urbanization, and alterations in land use patterns can influence rodent populations, resulting in fluctuations in pest pressure and necessitating the use of rodenticide solutions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

Spraying to hold the second-largest share in the mode of application segment.

Spray type of mode of application is projected to hold the second-largest share in the mode of application type segment of the rodenticides market. The application of pesticides through spraying may inadvertently impact rodent populations. For instance, if rodents ingest plants or insects treated with pesticides, they might consume toxic residues, resulting in either direct fatalities or weakened individuals. Consequently, this scenario may spur a heightened demand for rodenticides as an additional measure to manage rodent populations indirectly influenced by spraying.

The Urban Centers segment is expected to hold the largest market share in the end use segment of the rodenticides market.

Urban environments, characterized by dense human populations, offer ample food sources and shelter for rodents. The proximity of buildings, infrastructure, and waste management systems creates optimal conditions for rodent infestations to proliferate. In urban environments, a multitude of structures, including buildings, sewers, and subway systems, serve as shelter and nesting sites for rodents. Structural imperfections such as cracks and crevices in buildings provide entry points for rodents, facilitating their access to indoor spaces and heightening the risk of infestations.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=189089498

North America will dominate the rodenticides market during the forecast period.

North America has over 400 species of rodents, many of which have adapted to human environments and are considered pests in urban, agricultural, and forestry settings. Climatic changes, such as mild winters and warm springs, have fueled the reproduction and survival of certain rodent species, leading to outbreaks like that of house mice in the US. Major service providers report that approximately 60% of the global servicing market is attributed to North America, encompassing the United States, Canada, and Mexico. Rollins, Inc., Rentokil Initial plc, and Ecolab emerge as leading companies in this market segment, owing to the proliferation of services in the US and the high urbanization rates in both the US and Canada. These factors have led to an increase in rodenticide application in North America.

The key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), UPL (India), Neogen Corporation (US), Anticimex (Sweden), Ecolab (US), Rentokil Initial plc (UK), Senestech, Inc. (US), Rollins, Inc. (US), Liphatech, Inc. (US), JT Eaton & Co., Inc. (US), PelGar International (UK), Bell Laboratories Inc. (US), and Abell Pest Control (Canada). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, supported by manufacturing facilities and well-established distribution networks spanning across these regions.

- In May 2023, World Pest Control collaborated with Rentokil North America. World Pest Control has been serving residential and commercial customers for 69 years. The company is dedicated to providing pest control services that protect homes, families, and businesses.

- In January 2022, Syngenta Crop Protection completed the acquisition of two bioinsecticides NemaTrident and UniSpore, from UK-based Biomema Limited, which is one of the foremost players in bioprotection technology development. This acquisition would help the company strategize new developments under its pest management vertical.