Global Overview

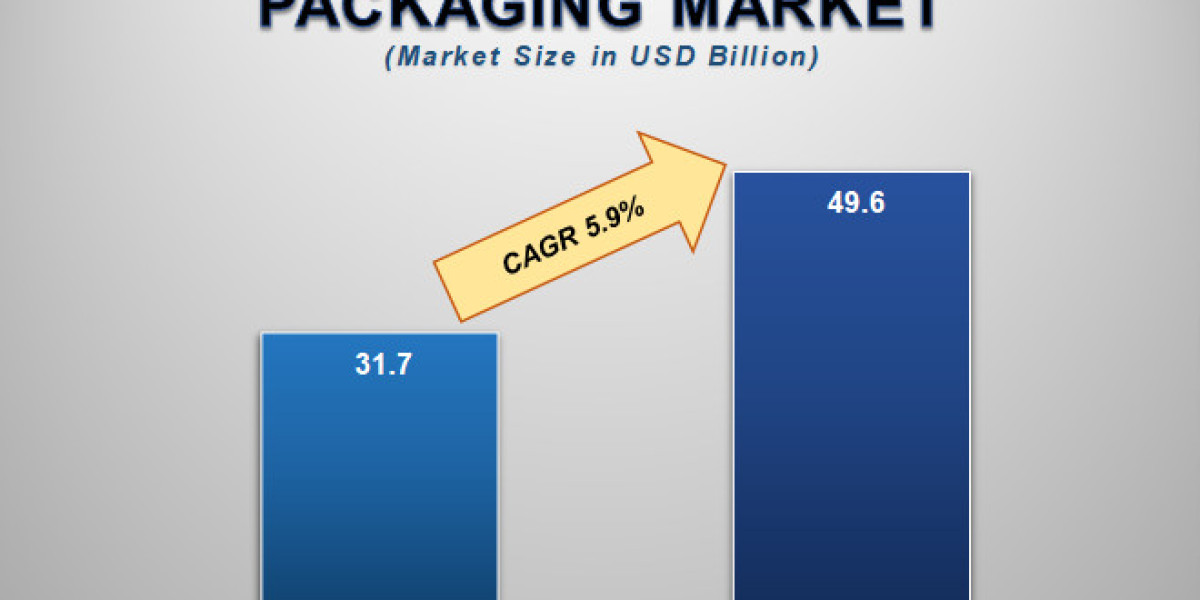

The Global Medical Device Packaging Market size is witnessing steady growth, driven by the increasing demand for advanced healthcare solutions, rising regulatory standards, and the growing need for sterile, safe, and reliable packaging formats. Valued at USD 31.7 billion in 2025, the market is forecasted to reach USD 49.6 billion by 2033, expanding at a CAGR of 5.9% during the forecast period. Medical device packaging plays a crucial role in ensuring the integrity, safety, and functionality of a wide range of medical instruments, consumables, implants, and diagnostic equipment. It must comply with stringent regulatory and sterilization standards while supporting efficient distribution and shelf-life preservation

- Get PDF Link : https://m2squareconsultancy.com/purchase

- Get Reports Links : https://m2squareconsultancy.com/reports/medical-device-packaging-market

By Segment

Materials

Plastics dominate (> 55% share in 2023), valued for lightweight durability, barrier protection, and sterilization compatibility (e.g. polyethylene, polypropylene, PVC)

Sustainability push: increased adoption of biodegradable plastics (PLA, PHA), mono-material films, antimicrobial and recyclable innovations

Metal packaging (e.g. aluminum trays and boxes) may grow fastest at a projected 7.1% CAGR due to superior barrier performance

Product Types

Pouches and bags accounted for over 35% share in 2024, leading by flexibility, surface-to-package ratio, and adaptability—often preferred for small devices and IVD kits

Other formats like trays, clamshells, blister packs, and boxes remain important for larger or rigid devices

Application

Sterile packaging dominates, critical for surgical tools, implantables, diagnostics; expected to remain high-growth, reaching over USD 40 billion by 2032

In-vitro diagnostics (IVD) packaging is projected to grow fastest (~7.6–7.9% CAGR), fueled by increased point-of-care diagnostics and infectious disease testing

Asia Pacific is expected to deliver the highest regional growth over 2024–2032, supported by increased healthcare access, domestic medical device production, and sustainability initiatives

Trends & Market Drivers

1. Smart & Intelligent Packaging

Integration of RFID, QR codes, sensors, and tamper-evident indicators to enhance traceability, inventory control, cold-chain monitoring, and anti-counterfeit capabilities

Smart packaging segment projected to grow at ~14% CAGR through 2032

2. Sustainability & Eco‑friendly Materials

Shift toward ** recyclable, biodegradable, mono-material** packaging systems, especially in Europe and North America

Approximately 65% of procurement decisions now emphasize eco‑friendly materials

3. User‑centric & Human‑factors Design

Packaging optimized for easy opening, labeling clarity, and ergonomic use by both healthcare professionals and patients, especially in home care settings and elderly-friendly device kits

4. Regulatory Pressure & UDI Compliance

Regulatory frameworks like FDA UDI in the U.S. and EU’s MDR/IVDR require standardized device labeling and traceability mechanisms—including package-based UDI marking and regulated data entry in EUDAMED/GUDID

EU’s MDR updates (2024–2025) added supply‑chain disruption reporting mandates, reinforcing traceability needs

Challenges & Barriers

Complex regulatory compliance especially for global manufacturers juggling varied rules across regions

Material and innovation costs: High-performance and sustainable materials often raise production costs, challenging especially small manufacturers

Supply chain logistics: Ensuring sterility, temperature control, and intact shipping in multi-tier global distribution remains complex

Strategic Opportunities

Emerging markets: Significant growth avenues in India, China, and Southeast Asia, aligned with rising device exports and domestic manufacturing efforts (e.g., “Make‑in‑India”)

Custom & turnkey service models: Providers offering end‑to‑end design‑through‑packaging solutions gain competitive edge

Sustainable innovation: Bio‑based polymer and compostable film R&D is attracting early-adopter hospitals, especially in Europe

Key Players & Industry Moves

Leading packaging firms include Amcor, Berry Global, DuPont, 3M, Wipak, Sealed Air, WestRock, and others

Recent consolidation: Amcor’s USD 8.4 billion merger with Berry Global in 2025 created a healthcare packaging powerhouse (~USD 24 billion revenue)

DuPont’s acquisition of Spectrum Plastics (2025) expanded its reach in specialty barrier films

Emergent players like Viant Medical and investments from UFP Technologies (e.g. new medical manufacturing facilities) are reshaping the competitive landscape

Conclusion

The medical device packaging market is robust and evolving, driven by:

Regulatory imperatives (sterility, UDI compliance),

Growing demand for smart, traceable packaging,

The expansion of eco-conscious, user-friendly designs,

And rapid growth in Asia–Pacific.

- Get More Reports Links :

- https://m2squareconsultancy.com/reports/humanoid-robot-market

- https://m2squareconsultancy.com/reports/hybrid-vehicle-market

- https://m2squareconsultancy.com/reports/dairy-alternative-products-market

- https://m2squareconsultancy.com/reports/hair-serum-market

- https://m2squareconsultancy.com/reports/sports-sponsorship-market