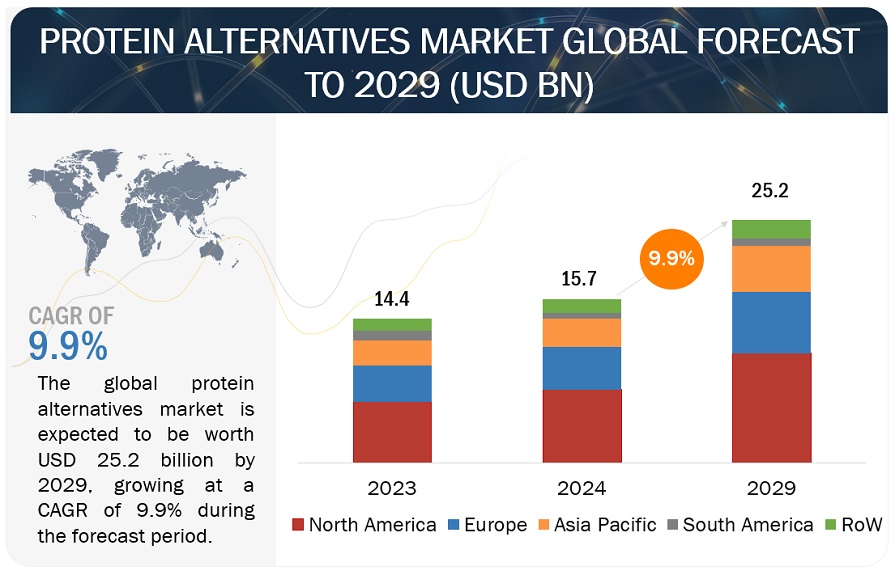

The protein alternatives market is estimated at USD 15.7 billion in 2024 and is projected to reach USD 25.2 billion by 2029, at a CAGR of 9.9% from 2024 to 2029. The recent rise in the popularity of alternative proteins, including plant-based, microbial, and insect proteins, can be attributed to several key factors, such as heightened health awareness, ethical considerations, environmental concerns, and diverse dietary preferences. Consumers are increasingly turning to these protein alternatives due to allergies, specific dietary needs, or a desire for healthier, more sustainable options. Notably, there is a growing preference for plain and unsweetened protein products, particularly among those seeking low-calorie and low-fat choices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=233726079

The dry sub-category is projected to hold the leading position within the form sector of the protein alternatives market.

In the rapidly growing market of protein alternatives, the dry form segment has emerged as a frontrunner, captivating consumers and industry players alike with its versatility and convenience. Dry forms of protein alternatives, such as powders and dehydrated products derived from plants like soy, peas, or even fungi like mycoprotein, offer numerous advantages. They are easy to store, have a longer shelf life, and can be easily incorporated into a variety of food products, ranging from beverages to baked goods. This adaptability has fueled their popularity among health-conscious consumers seeking plant-based options that align with their dietary preferences without compromising on taste or nutrition.

Moreover, the dry form segment's prominence in the protein alternatives market is underscored by its appeal to manufacturers and retailers. By offering products in dry form, companies can reduce transportation costs and optimize storage space, making distribution more efficient. Additionally, these forms often require less processing and preservation compared to their fresh or frozen counterparts, aligning with sustainability goals and reducing environmental impact. As consumer demand for protein alternatives continues to surge, the dry form segment is poised to expand further, driving innovation and setting new standards in the protein alternatives industry.

Plant protein is estimated to be the fastest source segment in the protein alternatives market during the forecasted period of 2024–2029.

Plant protein has rapidly emerged as the frontrunner in the protein alternatives market, prized for its speed of adoption and nutritional benefits. With consumers increasingly focused on health, sustainability, and ethical considerations, plant-based proteins offer a compelling solution. Unlike traditional animal-derived proteins, which often come with environmental concerns and ethical debates, plant proteins are generally more sustainable to produce and consume.

One of the key reasons for the swift ascent of plant protein on the market is its versatility. Manufacturers can extract protein from a wide array of plant sources, such as peas, soybeans, hemp, and even algae, offering a diverse range of products that cater to different dietary preferences and needs. This diversity fuels innovation, leading to products that not only match but sometimes surpass their animal-based counterparts in taste, texture, and nutritional profile.

Furthermore, plant protein's rapid digestion and absorption rate make it highly appealing to athletes and health-conscious individuals seeking efficient protein sources for muscle recovery and overall wellness. As research continues to highlight the health benefits of plant-based diets, including reduced risks of chronic diseases, the popularity of plant protein is expected to continue its meteoric rise in the protein alternatives market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=233726079

The North American region is projected to dominate the protein alternatives market.

North America stands as the dominant region in the protein alternatives market, owing to its robust infrastructure, technological advancements, and growing consumer demand for sustainable food sources. This leadership is underscored by strategic developments such as in January 2022 ADM's (US) collaboration with Innova Feed (France), aimed at supplying insect protein for ADM's pet food division while leveraging waste heat and water resources effectively. This partnership not only enhances ADM's product offerings but also reinforces sustainability initiatives in the pet food industry. Similarly, In May 2021, Cargill's (US) strategic partnership with InnovaFeed (France) focuses on supplying insect feed for aquaculture and integrating insect oil into pig feed, addressing the increasing need for innovative protein sources in animal nutrition. These collaborations highlight North America's pivotal role in advancing protein alternatives through strategic alliances that promote sustainability and technological innovation in the food and feed sectors.

Key Market Players in this include Tate & Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland, ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), AGT Food and Ingredients (Canada), Tate & Lyle (UK), PURIS (US), Ynsect (France), Global bugs (Thailand), and Innovafeed (France).