Okay, confession time: most of us don’t really understand how taxes work. We just hope for a decent refund and pray we’re not screwing something up. But here’s the thing — there’s a whole toolbox of tax-saving options just sitting there, and barely anyone is using them right.

This isn’t about tax evasion. It’s about being smart. And no, you don’t need to be a finance nerd or wear a suit to figure it out.Let’s unpack the stuff your accountant might not explain unless you ask (or unless you're paying them way too much).

1. Taxation Laws Are a Game — Learn the Rules

Think of taxation laws as the rulebook. You don’t have to love them, but if you know how they work, you can play smarter. There are write-offs, exemptions, loopholes (legal ones!), and even tax treaties that save you from being taxed in two countries if you freelance or invest internationally.

It’s not cheating. It’s literally how the system is designed. You either learn the rules, or you keep overpaying.

2. Tax Harvesting: The Legal “Oops I Lost Money” Hack

Here’s a beautiful thing: if your investments tanked — congratulations. You might be able to use that to your advantage.

It’s called tax harvesting, or if you want to sound fancy, portfolio tax loss harvesting.

How it works:

You sell stuff in your portfolio that’s gone down (crypto, stocks, whatever).

That loss? You can subtract it from gains you made elsewhere.

It’s like turning failure into... slightly less failure.

Plus, those capital losses? You can carry them forward. It’s like the hangover that keeps giving, but in a helpful way.

3. Crypto Tax Harvesting Is Real (Yes, Even for That Altcoin You Regret Buying)

If you’ve dipped your toe into the crypto universe and lost money (don’t worry, we all did), here’s the upside: crypto tax harvesting lets you sell off your sad coins to claim the loss. Then, if you really believe in them, buy them back after a bit.

Just check if your country’s tax authority has “wash sale” rules for crypto — some do, some don’t. Either way, you might be able to get creative without breaking the rules.

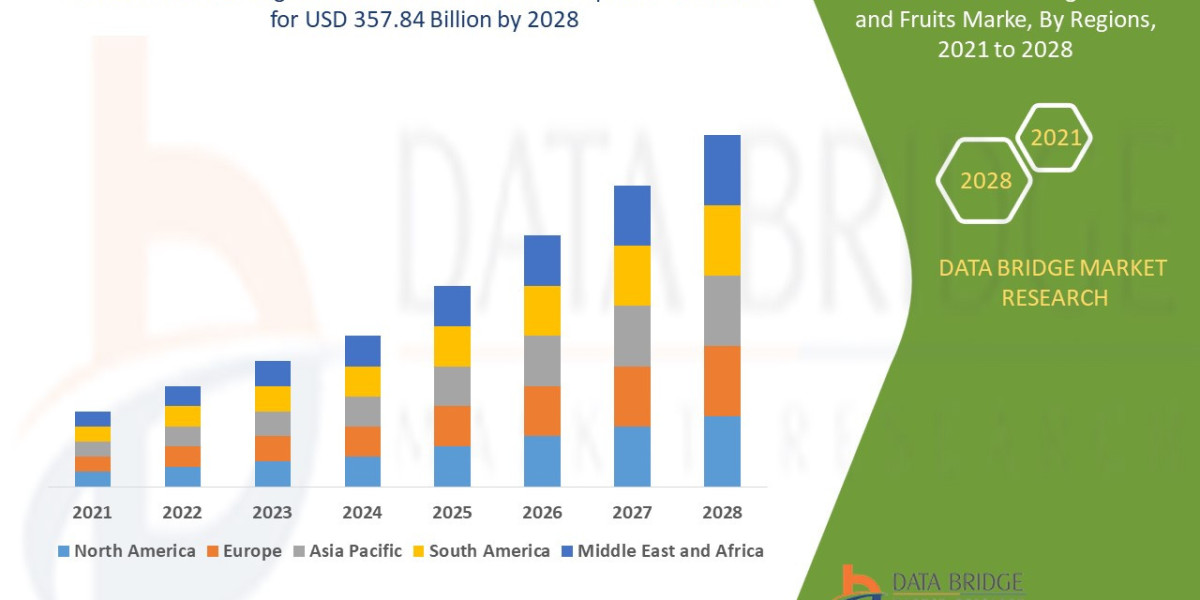

4. After-Tax Returns > Gross Returns

So you made $10,000 investing this year? Cool. But what did you actually keep?

That’s the question of after-tax returns — and it’s the number that really matters.

Some quick ways to boost that number:

Hold assets longer (long-term capital gains = lower tax)

Invest through retirement accounts (they’re like tax shelters but legal)

Offset gains with those capital losses we talked about

Big numbers are cool, but big numbers after taxes are cooler.

5. Capital Losses Are the Unsung Heroes of Tax Season

We usually hate losses. But in the tax world? Losses are lowkey amazing.

Let’s say you sold a stock and lost $2,000. That loss can:

Offset other gains

Reduce your taxable income

Get carried forward for next year

Make you feel slightly better about making bad investment decisions

Capital losses are like coupons for your future tax bill. Clip them.

6. The Tax Treaty Thing No One Talks About

If you’re working across borders or making money from foreign sources (freelancing, remote jobs, overseas investments), there’s a good chance your income is covered by a Tax Treaty.

That means you might not have to pay taxes twice on the same income. But you need to file the right paperwork and tell the system what you’re doing — it won’t guess.

This one is boring but totally worth Googling for your specific country.

Final Thoughts: You're Not Dumb, Taxes Are Just Ridiculous

No one teaches us this stuff in school. But once you see how the game works, you’ll never look at tax season the same way again.This isn’t about beating the system. It’s about not getting beat by the system. Start with the basics, make a few smart moves, and next year’s taxes might just feel… slightly less painful.